Interos is monitoring supply chain impacts in Taiwan following the 7.4 earthquake that shook the region overnight. Our hearts go out to the people of Taiwan as they cope with the extensive damage. At least 9 casualties are reported with hundreds more injured. In addition to the tragic loss of the life, the quake, the worst since 1999, is reverberating across global electronic and the semiconductor supply chains, causing disruptions in chip manufacturing operations. Semiconductor chips are vital to dozens of products including computers, cellphones, auto, industrial machinery, and more.

Impact on Semiconductor Supply Chains

Key chip producers like TSMC and UMC temporarily closed operations to conduct facility inspections and ensure employee safety. While employees have returned and some operations resumed, ongoing inspections are expected to take time and may impact production schedules. Even short factory closures can lead to millions of dollars in delays and one report estimated a significant semiconductor disruption in Taiwan could affect up to $1.6 trillion, or approximately 8%, of annual U.S. GDP.

Within the semiconductor market, Taiwan-based companies account for approximately 60% of global production and approximately 90% of production of advanced semiconductors. The quake temporarily suspended chipmaking machinery and evacuated personnel from various semiconductor manufacturing facilities, impacting the production of advanced process nodes. Since highly sophisticated semiconductor fabs need to operate in a continuous vacuum state for several weeks, the temporary halt in operations, especially for advanced nodes like 4/5nm and 3nm, could lead to delays in shipments and increased pressure on pricing within the semiconductor sector.

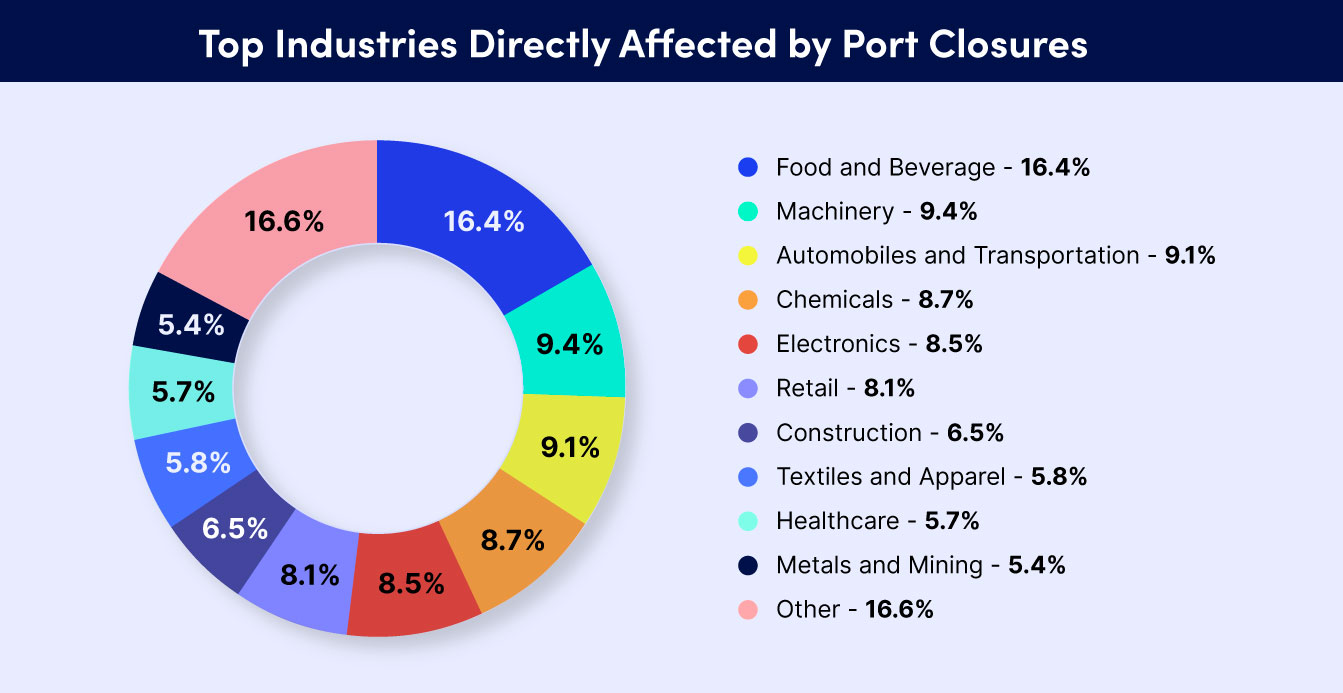

Further, while manufacturing plants may not have been directly affected by the earthquake’s epicenter, the temporary shutdowns and inspections in Taiwan may lead to delays in chip-making machinery and semiconductor shipments to surrounding countries that rely on Taiwanese products for their own production processes. These delays could result in production bottlenecks and inventory shortages in various industries, including electronics, automotive, and consumer goods.

Dependence on Taiwanese Supply Chains

The semiconductor industry is heavily concentrated in Taiwan, which had around a 63% global market share of chip manufacturing in 2020. Integrated circuits (ICs) and micro assemblies accounted for 35.6% of Taiwan’s total exports by value in 2020 – 10X bigger than the next category. Taiwan dominates manufacturing of cutting-edge chips used in advanced commercial and military technologies, producing over 90% of global output featuring transistors smaller than 10 nanometers. Taiwan’s Semiconductor Manufacturing Company (TSMC), a supplier to Apple, Nvidia, and other technology giants, has a 53% global market share, and with a market capitalization of over $550 billion.

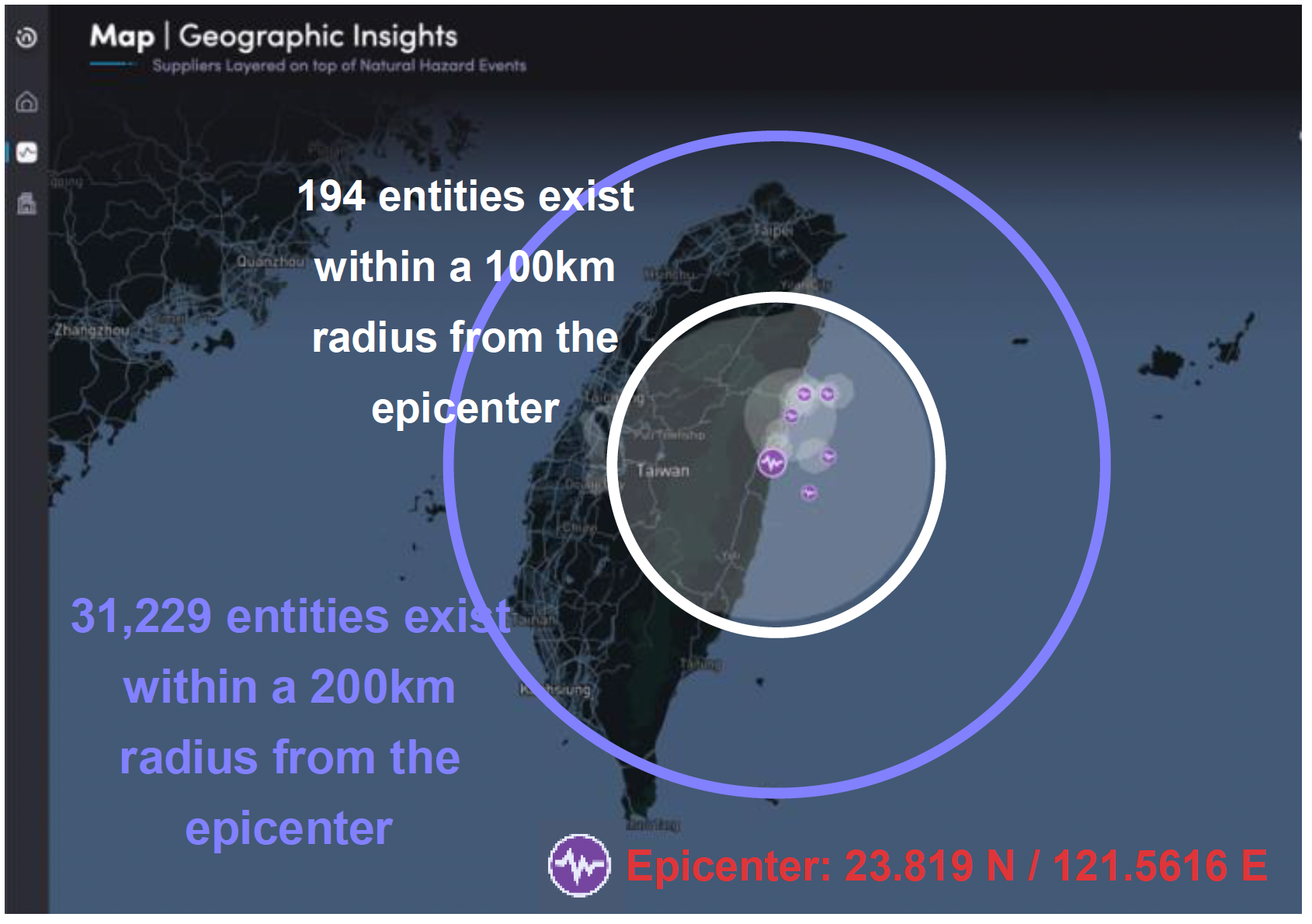

Analysis of Supply Chain Relationships

Dependence on Taiwanese supply chains among G7 countries is extensive. An analysis of Interos’ global database of business relationships shows:

- U.S. companies have almost 70,000 direct (tier-1) relationships with Taiwanese suppliers. Companies in other G7 member countries have almost 10,000 between them.

- When indirect multi-tier relationships are included, G7 member companies have more than 315,000 tier-2 and 750,000 tier-3 connections to Taiwanese firms.

- Although tier-1 relationships with the two major Taiwanese semiconductor manufacturers, TSMC and United Microelectronics Corp. (UMC), are relatively small in number (led by the U.S. with around 220), as tier-2 and tier-3 suppliers these two companies are present in hundreds of thousands of supply chains in G7 countries.

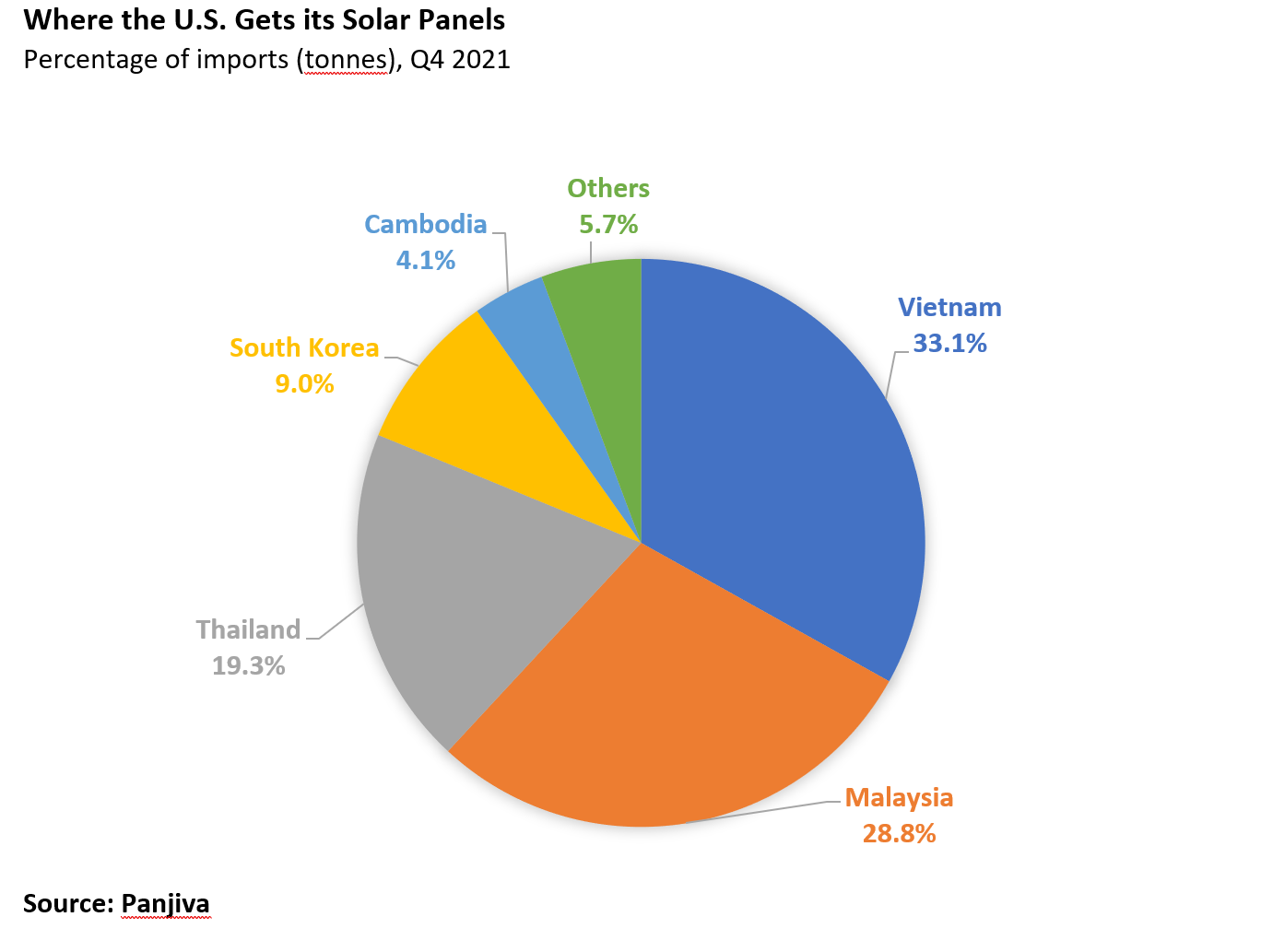

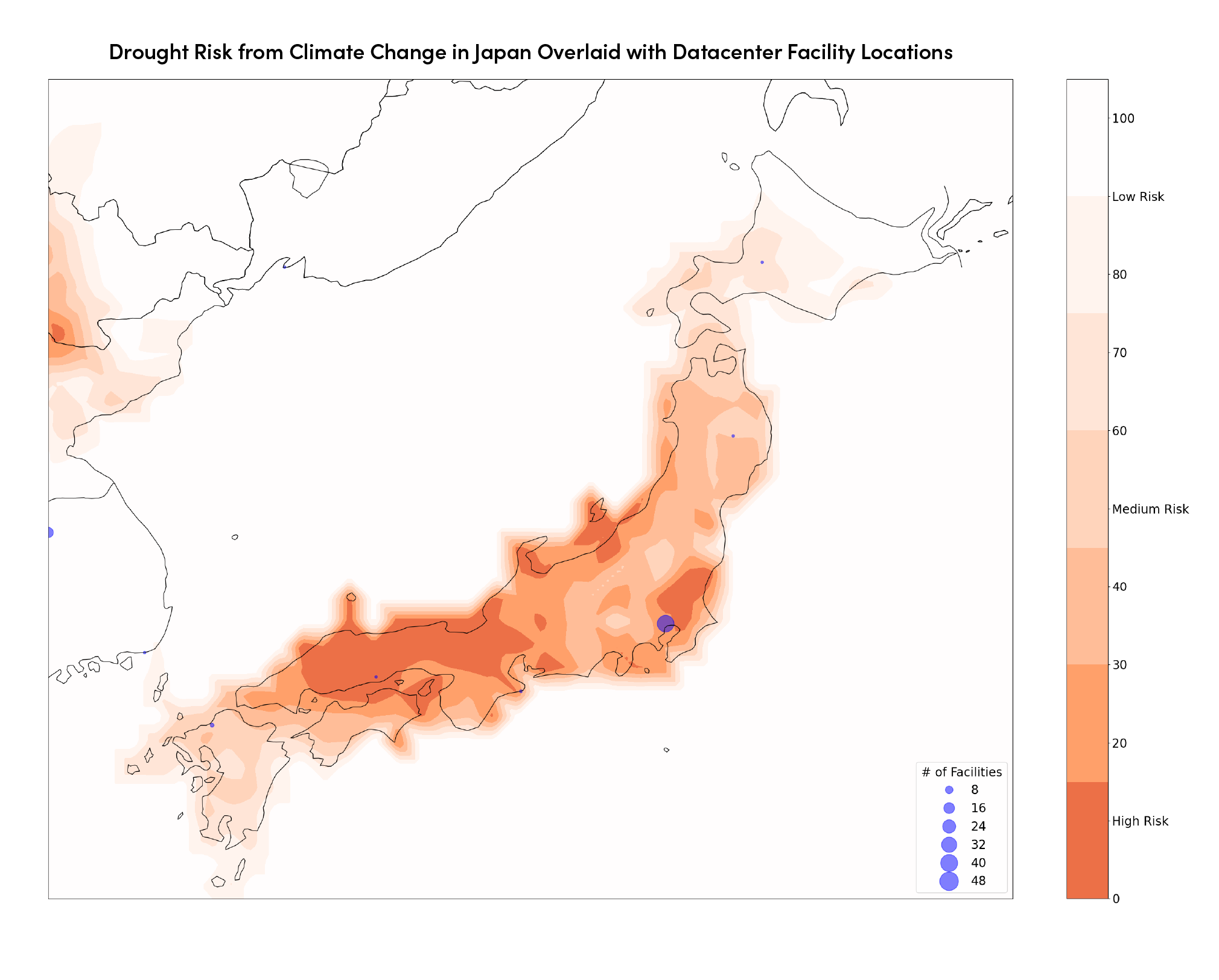

Analysts say the situation may cause a short-term delays to regional electronic manufacturing companies in Japan, Korea, China and Vietnam. Interos will continue to provide supply chain updates and information as the situation unfolds.